Posts

- 50 lions pokie machine big win: JPMorgan and you can Deutsche Financial Get in on the Chorus

- GameStop Narrows Q2 Loss since the Bitcoin Holdings Improve Equilibrium Layer

- Organization

- Online casinos favoritos de VegasSlotsOnline

- XRP Rallies 8% away from Daily Downs because the Organization Volume Forces Speed More than $step 3

The brand new accounting price away from go back (ARR) try a monetary metric always measure the success away from an money. It’s computed by the splitting the average yearly profit by the fresh initial investment and you may stating it a percentage. In this instance, the fresh project’s mediocre annual profit try bad (-$sixty,010), appearing that venture isn’t promoting self-confident efficiency.

- Come across information regarding Atomic Broker within their Setting CRS, General Disclosures, fee schedule, and you may FINRA’s BrokerCheck.

- However, equity in terms of pricing is a new build and may also not guaranteed.

- The brand new Cup-Steagall Act try repealed inside 1999 in the middle of enough time-position concern that constraints they imposed to the financial industry have been below average and this enabling banking institutions so you can broaden manage eliminate risk.

- Centered on Hamza, the police had been along with yelling gossip your somebody delivering arrested were of Hamas “and so they attended to get rid of Cairo.

50 lions pokie machine big win: JPMorgan and you can Deutsche Financial Get in on the Chorus

This type of developments are the amplification away from issues as a result of social network and the interest rate of a few depositor answers, the brand new communications from inability-quality situations and you can depositor choices, plus the enhanced volume and proportion away from uninsured dumps from the bank operating system. Exactly what the Wall Road Journal provides finished with which declaration is to unlock an excellent Pandora’s container concerning your billions of international places kept inside foreign branches of JPMorgan Pursue and Citigroup’s Citibank – not one at which are protected by FDIC insurance coverage. They after that enhances the question as to the reasons the brand new financial authorities of these two Wall surface Street mega banking companies provides welcome so it hazardous problem that occurs. “This action because of the The united states’s biggest banks reflects its confidence within the First Republic as well as in banking institutions of the many models, and it demonstrates its total commitment to enabling banking companies suffice its people and you will organizations,” the group told you inside the an announcement. “This task by America’s largest banks reflects its believe inside the Very first Republic plus banking companies of the many models, and it also demonstrates the full commitment to providing financial institutions serve their customers and organizations,” the group told you inside an announcement. Contrast one to to your national average family savings rates out of 0.46% APY and see that you stand-to secure slightly a bit more because of the getting your bank account within the a top-paying checking account.

It declaration signifies that whilst complete 50 lions pokie machine big win demand for wheat have not changed, extent demanded have diminished to some degree as a result of your rate boost. While the rates have increased, demand have not changed but quantity necessary features fell specific. The newest reference to the “invisible hands” indicates the concept of industry forces, where the communication out of likewise have and you can request decides rates. Considering it report, the fresh invisible give is seen as the fresh driving force behind the fresh ascending wheat rates. Following stock exchange freeze within the 1929, over 9,100 banking companies in america hit a brick wall along the second five years.

Once they take action properly, they’ll obtain prize regarding an excellent big extra. Consultative profile and functions are provided because of the Webull Advisers LLC (called “Webull Advisors”). Webull Advisors is a good investment Advisor registered with and you can controlled by the the fresh SEC within the Investment Advisors Operate of 1940. Deals on your Webull Advisers account are executed by Webull Financial LLC.

A gain or lack of a transaction might be submitted owed to help you movement reciprocally rates. Because the yen depreciates prior to the usa dollars, Badel makes an increase on the deal. As the money suppleness out of request are negative, it indicates one oranges are a normal an excellent. However, the newest magnitude of your elasticity (-0.8) shows that the fresh need for oranges can be a bit inelastic. Put simply, an excellent 10% escalation in earnings causes an 8% reduced amount of the brand new interest in apples. We could finish you to definitely apples is a normal a good which have an enthusiastic income flexibility from consult of 1.dos.

GameStop Narrows Q2 Loss since the Bitcoin Holdings Improve Equilibrium Layer

This can include offering novel facilities otherwise functions, performing personalized guest feel, concentrating on a particular audience portion, otherwise leveraging technical to add innovative characteristics. The newest taxation impression idea postulates you to definitely buyers often prefer straight down dividend costs in case your income tax costs to the funding growth is actually less than the new income tax prices for the returns. For this reason, Peterson and Peterson Organization may go through lowest need for dividend percentage when it theory holds. A forward price arrangement (FRA) try a cash-settled over-the-stop package between a couple of events, and that claims the fresh sales or acquisition of a main investment, such a thread or financing, from the a predetermined interest at a specific coming date. It’s used in hedging and you can conjecture on the interest activity. Great things about Debt FinancingThe cost of financial obligation financing is usually down compared to cost of equity money.

Organization

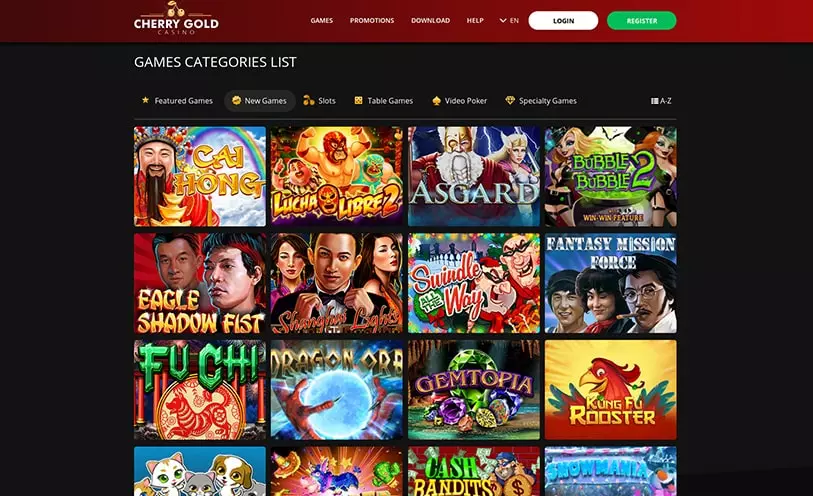

It offers more 5,100000 casino games and you may a comprehensive sportsbook, allowing professionals so you can enjoy and choice using a variety of cryptocurrencies, as well as $WSM. The stress on the NYCB’s procedures and you may profits in the middle of raised rates of interest and you may an excellent murky outlook to possess mortgage non-payments has raised questions while the so you can if or not NYCB, a good serial acquirer out of banking companies until recently, might possibly be forced to promote itself to a far more secure mate. The new revelation is an excellent “tall question one to indicates credit costs would be large to own an enthusiastic expanded several months,” Raymond James specialist Steve Moss told you Thursday inside a study notice. “The new disclosures add to all of our fear of NYCB’s attention-just multiple-loved ones collection, that may want a lengthy work-out several months unless rates refuse.” All the amounts you to a specific depositor features in one or more account inside a single type of control group during the an individual kind of lender are added together with her and so are insured up to $250,100. To love Robinhood’s initial cost-free inventory providing, you can utilize one of their marketing and advertising hyperlinks then money your bank account with the very least deposit away from $10.

Through the a couple of banking crises—the new savings and financing crisis and also the 2008 financial crisis—the new FDIC expended their entire insurance rates financing. Just like offers and cash field account, starting a Cd with an enthusiastic FDIC-covered lender otherwise NCUA-insured borrowing relationship have a tendency to manage their financing if your establishment goes wrong, and then make Dvds about exposure-totally free. To keep some thing risk-totally free, just make sure the new high-produce family savings your open was at both a bank that’s covered because of the Federal Deposit Insurance Business (FDIC) or a card partnership insured because of the National Credit Connection Administration (NCUA). By sticking to representative establishments of the two federal companies, your dumps as high as $250,100 for each institution would be secure from the unlikely experience one the lending company or credit relationship fails.

The brand new crisis laws that has been introduced in this times of President Franklin Roosevelt getting place of work inside March 1933 was only the beginning of the method to replace believe on the bank system. Congress watched the necessity for generous change of your bank system, which ultimately came in the newest Financial Work out of 1933, and/or Glass-Steagall Operate. Cup, a former Treasury secretary, try the main push about the fresh operate. Steagall, following president of the house Banking and you will Money Committee, offered to support the work having Cup immediately after an amendment is actually put into enable bank put insurance coverage.step 1 On the June 16, 1933, President Roosevelt closed the balance to your law. Glass to start with produced their banking reform costs inside the January 1932. They received comprehensive analysis and statements away from bankers, economists, plus the Government Reserve Board.

The new bad ARR shows that your panels isn’t appointment the newest expected income membership to fund the expenditures and generate money. Ahead of the passage of the fresh act, there have been zero limitations on the right out of a financial manager away from a part bank to help you acquire out of one bank. Excessive financing so you can financial officials and you may administrators turned an issue so you can bank bodies. In response, the fresh operate banned Government Set-aside member loans from banks on their executive officials and you may needed the new fees of a great fund. 55 Wall Street’s stone facade includes a couple stacked colonnades against Wall structure Road, per with 12 columns.

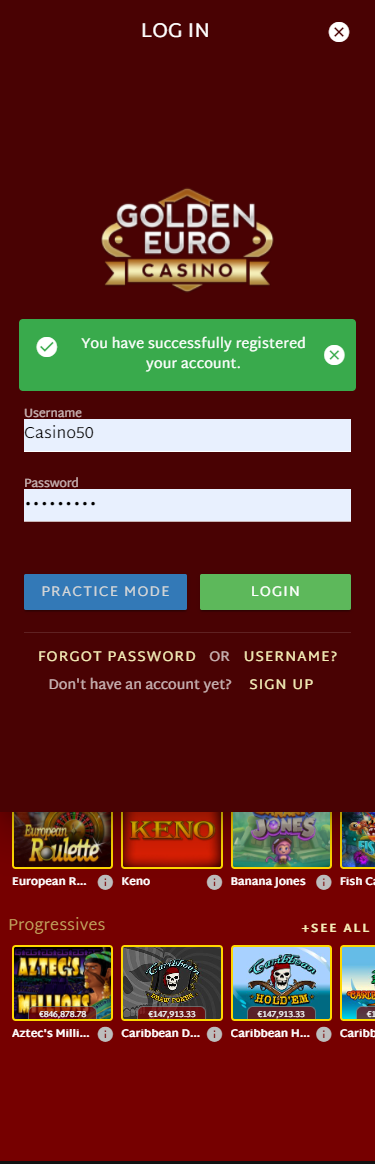

Online casinos favoritos de VegasSlotsOnline

After that process ensures that you can aquire your very first totally free express cherished between $5 and you may $two hundred. Robinhood is powering a totally free inventory promotion to your few days away from Sept, 2025, offering new registered users around $step 1,700 inside the 100 percent free stock throughout their first 12 months. To take advantageous asset of that it offer need discover and you will financing your bank account which week becoming qualified; Robinhood transform the promos seem to referring to an educated i features ever seen from their website. Find the has you to number really for you, as well as take a trip pros, perks items, and a lot more.

XRP Rallies 8% away from Daily Downs because the Organization Volume Forces Speed More than $step 3

A group of creditors have wanted to put $31 billion inside Very first Republic in the what is supposed to be a good manifestation of rely on regarding the bank system, financial institutions revealed Thursday mid-day. To wake up the brand new mega banks on the Wall surface Street on their very own susceptability which have uninsured dumps in addition to security the fresh DIF’s losses, the brand new FDIC released an offer on may 11 to help you levy a good special evaluation in line with the private lender’s holdings away from uninsured deposits at the time of December 30, 2022. The new evaluation perform total a fee away from 0.125 % of a lender’s uninsured deposits over $5 billion. The greatest APY deals profile aren’t often the of those to your large interest levels unless you care for an equilibrium away from not all the thousand dollars. SoFi is appealing to the fresh otherwise student traders, thanks to its member-friendly platform and product range, and financial account and instructional seminars.

Don’t Tune is something one’s a great idea commercially, but one that hasn’t worked well used. There are many procedures, nevertheless these are the fundamental record gadgets only at that writing. Knowing which privacy devices to utilize hinges on and you can you to of those some thing’lso are concerned with staying individual. Program response and you may account accessibility minutes may vary due to a great form of issues, along with change volumes, business standards, system overall performance, and other points.

With Varo’s checking account, your ft rate of interest starts at the 3% APY. But hold off another—you can get an excellent 5% APY raise if you meet so it financial’s standards. Written down, Varo gives the most glamorous APY which have a 5% attention bank account, however, one to’s perhaps not commercially the best package. NerdWallet’s complete comment process assesses and you will positions the largest You.S. agents by property lower than management, in addition to emerging industry players. Our very own aim should be to give another evaluation from organization to let case your with information and make sound, told judgements on which of those tend to finest meet your needs.